Resolution Checking®

Life happens, and sometimes money gets messy. Bounce back with this special account.

Build back credit, but with help. The first step: one simple checking account.

For members who don’t qualify for our All Access Checking or Perks+ Checking accounts, the road to better financial standing isn’t closed. Hit reset with no minimum balance requirement, no direct deposit requirement, and no fuss. For a $10/month service fee, you get:

- Visa® debit card

- Digital banking tools

- Access to 30,000+ ATMs

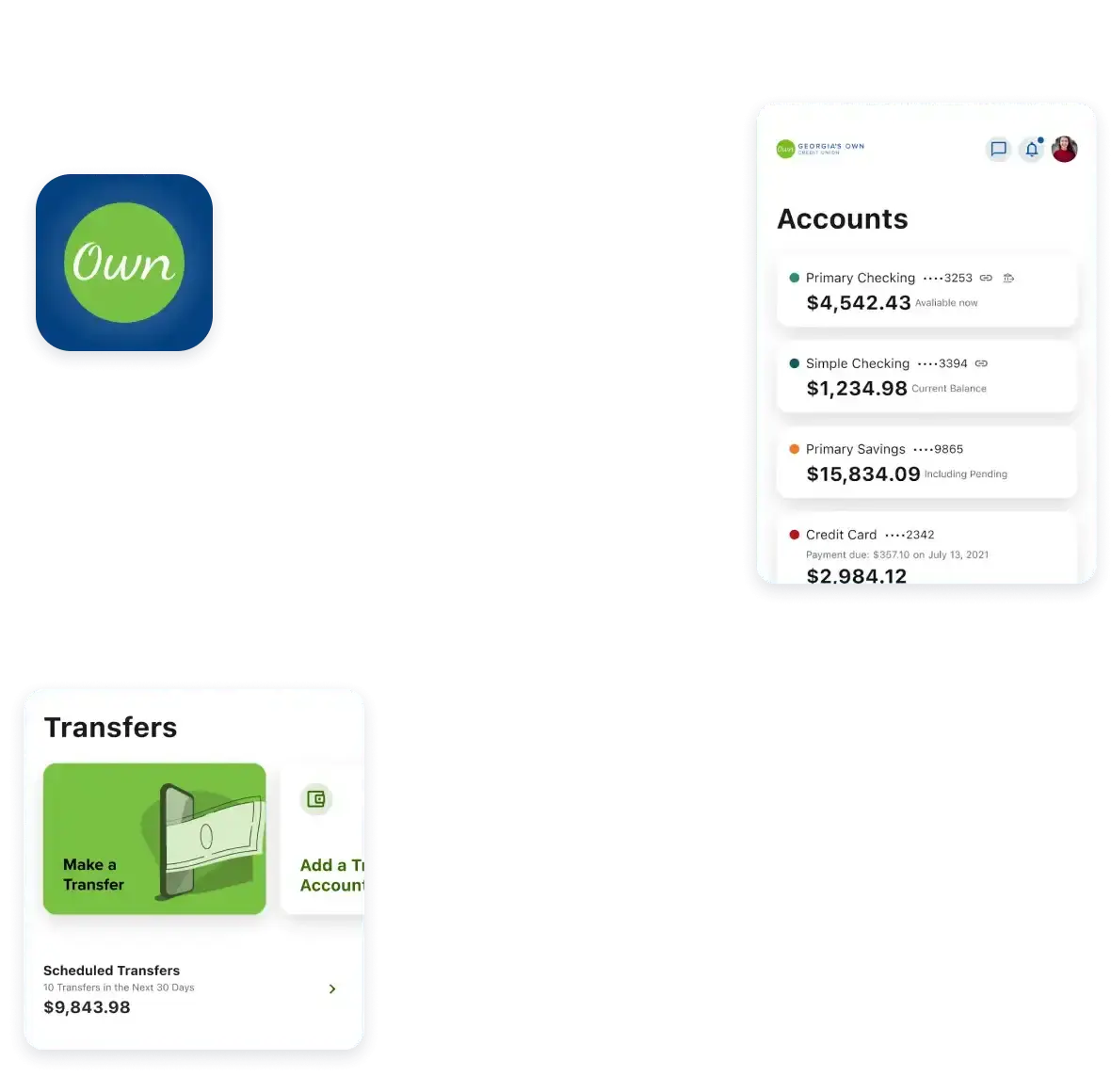

Track cash on the go

Meet the ultimate time-saver: the Georgia’s Own mobile banking app. Available on the App Store® and Google Play™.

- Check balances

- Make transfers

- Find branches and ATMs

On your way to winning

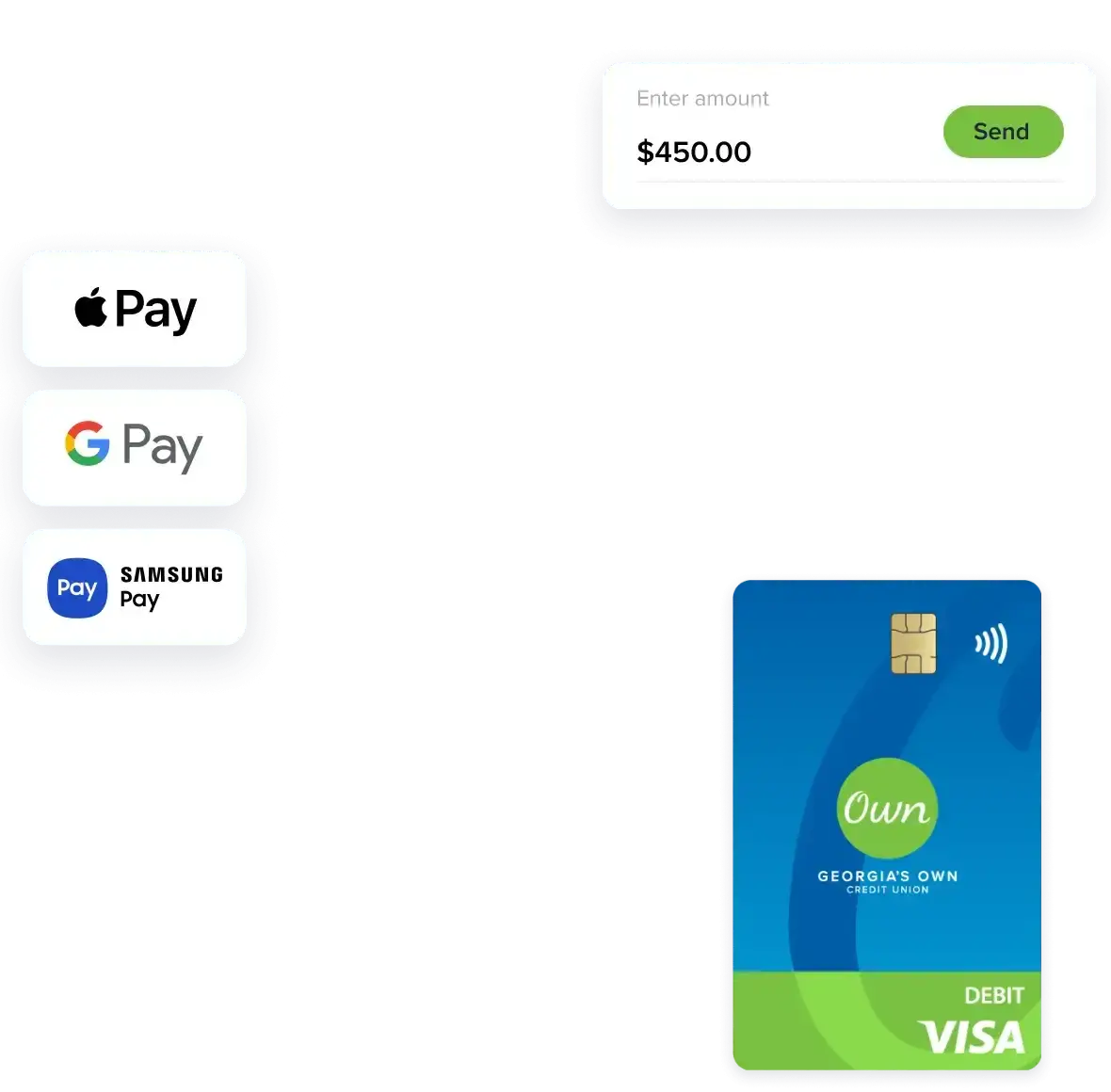

Make smart choices with every swipe (or tap!). Use your debit card to pay for everyday purchases, from gas and groceries to bills, anywhere Visa debit cards are accepted.

- Works with Apple Pay®, Samsung Wallet®, and Google WalletTM

- Chip-enabled and contactless for enhanced security

- Fight fraud with free text alerts1

Resolution Checking FAQs

A Resolution Checking account is an alternative, second-chance bank account available for those who want to re-establish financial security after previous checking account problems. With a Resolution Checking account, you can cash or deposit checks, make transactions online, pay bills, and withdraw cash at a branch or ATM.

All qualified Georgia’s Own members who do not qualify for Perks+ Checking or All Access Checking can open a Resolution Checking account.

There are five ways you can qualify for membership:

- By residence or employment within certain counties in metro Atlanta, Southeast Georgia, Southwest Georgia, Augusta, and Savannah

- Getting Ahead Association membership

- Past or present Georgia State University enrollment or employment

- Relation by blood, adoption, or marriage to a current Georgia’s Own Credit Union member

- Premier Partner employee or retiree.

Visit our membership page to see if you qualify.

In most cases, yes. Many online retailers will allow payment using your checking account information, like using your debit card. You can also make online purchases with your checking account information by verifying your account with a digital wallet or financial transaction app such as PayPal or Venmo.

Yes, you can apply for a checking account online. If you’re not a member of Georgia’s Own Credit Union, you will be able to apply for membership at the same time that you apply to open an account.

During the application process you will need:

- Your Social Security Number

- A valid U. S. driver’s license or other approved, government-issued I.D.

- Physical address information (P.O. Boxes can be used for mailing purposes, but a physical address is required for the online application)

- If under 18, an adult is required to open the account and be a joint owner.

Learn more about opening a checking account online.

Clean credit? You might qualify for one of our other accounts.

Learning Center

Go beyond banking with resources and news to help you make informed financial decisions.

What’s the safest way to pay: check or debit card?

What is a certificate of deposit and is it right for you?

How to build your credit score

1Message and data rates may apply.